For half a century, the IRS’s Volunteer Income Tax Assistance (VITA) program has offered free tax preparation assistance to elderly, disabled, and low-and moderate-income households. Funded through a federal grant, the program costs just $15 million dollars annually but returns $1.9 billion to communities.

By utilizing VITA’s trained volunteers and avoiding high-fee tax preparation services, each year more than 1.3 million families maximize their tax refunds and thereby increase financial well-being. VITA volunteers ensure that eligible taxpayers take advantage of the Earned Income Tax Credit (EITC), the largest and most effective anti-poverty program in the United States today, according to Prosperity Now.

In North Carolina last year, nearly 29,000 taxpayers received a total of $33 million in federal refunds, in addition to saving an average of $273 in tax preparation fees.1 That’s a lot of economic power returned to the pockets of hardworking North Carolinians!

Efforts are underway to permanently fund VITA and increase funding to twice the current level, which would expand its impact by recruiting more volunteers, opening new sites, and increasing public outreach so that more families can benefit.

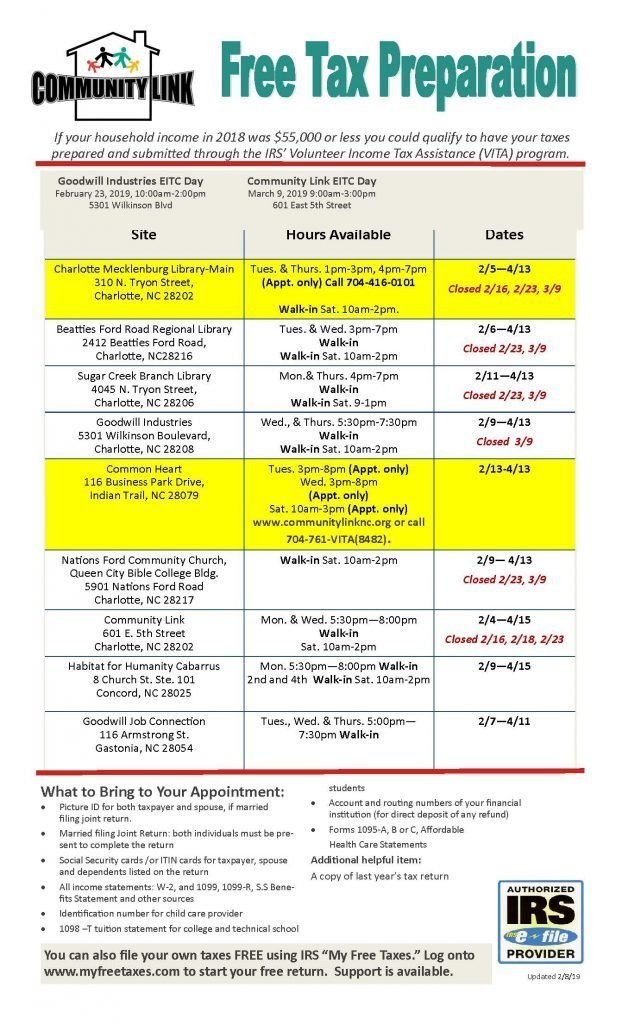

Know someone in Mecklenburg County who might benefit from free tax preparation this year? Check out one of the following VITA sites.

Happy 50th Birthday, VITA!

1Prosperity Now using IRS data sourced from VITA/TCE programs, 2019